What Is Abcd Pattern

Contents

In this case, the D point is the https://topforexnews.org/ entry-level, stop-loss is placed above the D level, and profit targets are placed at the C and A levels. But no worries, you don’t need to calculate the lines and Fibonacci ratios on your own. Luckily, nowadays, on many trading platforms available to retail investor accounts , you’ll be able to use a built-in ABCD indicator that automatically draws the pattern for you. Once you understand what the ABCD pattern is in trading, you can learn how to find it on the charts yourself.

Last week the https://en.forexbrokerslist.site/ was consolidating after the big push of the dollar two weeks ago. Keep in mind that price will not always hit all Fibonacci levels exactly but it should do so in close proximity. Trades often confuse the ABCD pattern with the Three-Drive pattern.

If volume breaks out at the same time the price does, that is a much stronger signal than a price breakout with low volume. Patterns are an important aspect of trading and traders love and naturally count on them when placing small and big trades. Once you’ve conducted thorough research and composed a sound trading plan, it’s important to exercise patience and discipline.

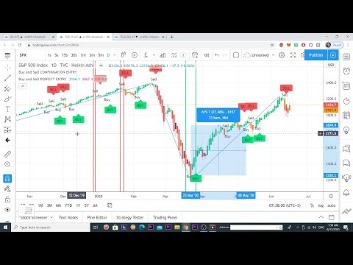

Identifying the indicator on a price chart is the first step to opening your position. Multiday charts generally offer insight into the behaviour of stocks and markets over an extended period of time. An important thing to realize about harmonic patterns is that we can derive the likely extension levels depending on the retracements in the first steps of the formation process. Here’s a general guide of the relationship between the possible point C retracements and the appropriate BC projection to each. Short-term traders view the pattern on daily or weekly charts to find the potential reversal and then apply it in their trading strategies.

Don’t forget to have a look at senior timeframes when you hunt for support and resistance levels. In other words, when the pattern reaches the “D” in the abcd, it’s time to take a counter-trend trade. However, there are many alternative ways to trade the abcd pattern as a scalper in the direction of the primary trend. The abcd pattern should be in every trader’s arsenal of trading patterns and trading strategies.

Setting Up the “Support and Resistance Based on 240 Bars” Trading Strategy

In this example, you might notice that some of the patterns converge. This provides a stronger trading signal than a single ABCD pattern in isolation. Do you know if you do better with long or short trades? Identify your strengths and weakness as a trader with cutting-edge behavioural science technology – powered by Chasing Returns. Forex trading is the buying and selling of global currencies.

Volume correlates with the prevailing tailwind in either direction of the abcd pattern. If the pattern is moving upward, you want to see strong demand, then weak supply, then strong demand once again. Another school of thought connects the middle of the trend. You can see in this next image that we have connected the middle of the B to C pullback instead of the high and low. Each ABCD trading pattern has both a bullish and bearish version. As you can see from the diagram above, an ascending ABCD pattern is bearish, while a descending ABCD pattern is considered bullish.

At this point, you should not enter the trade since you aren’t sure where the dip of the pullback is going to be. It’s important to remember that you shouldn’t use the ABCD trading pattern in isolation when speculating on future price movements. Your positions should be supported by extensive technical analysis and fundamental analysis. The bullish ABCD patterns is a mirror image of the bearish ABCD, thus all the rules and tactics apply equally to both patterns. For the purpose of explaining the rules and tactics to trade the patterns, we will use the bearish ABCD. You can apply the same rules to the bullish counterpart in the reverse direction.

How to trade with the ABCD Pattern in Trading?

These articles shall not be treated as a trading advice or call to action. The knowledge and experience he has acquired constitute his own approach to analyzing assets, which he is happy to share with the listeners of RoboForex webinars. A second advantage that the pattern offers is a trade entry with clearly defined and limited risk. Running an initial stop-loss order just on the opposite side of point D gives traders the chance to take a low risk trade. The ABCD pattern is sometimes traded as a continuation pattern of an existing trend. For example, if the pattern forms during a prevailing uptrend, a trader may look to buy around point C, with an eye to taking profits around point D.

- Also, the time to complete retracements A and B should be equal.

- Making money using ABCD pattern trading is simple enough and includes basic math.

- FXOpen offers ECN, STP, Micro and Crypto trading accounts .

- The easiest way to identify the ABCD pattern is to look for three price swings in any trend direction, creating a zigzag shape.

- It looks like a diagonal lightning bolt and can indicate an upcoming trading opportunity.

The easiest way is with the help of special tools – indicators or chart assistants, such as ZUP and Autochartist. The first of these is that each of the three price swings usually occurs over a time frame of between three and 13 candlesticks . Therefore, if any of the legs of the pattern are formed outside of that time frame, then the validity of the pattern is questionable. The first version of the ABCD signals an impending market reversal trend change from uptrend to downtrend.

Step 3: Set Alerts

However, many active traders choose to utilise the ABCD within the context of a trend-following gameplan. The first thing to note is that the pattern is created by human beings who are constantly buying and selling in the market. This means that there is a lot of emotion involved in the creation of the pattern.

Trading Station, MetaTrader 4 and ZuluTrader are four of the forex industry leaders in market connectivity. Now that you know how to trade with the ABCD pattern, there are a few things that you need to consider before trading it. A – The start of the pattern which is marked by a significant swing low. We are a globally regulated CFD broker which provides fast execution, transparent pricing and advanced charting tools for our clients. Set stop-loss below point C, if the price goes below C then sell and accept the loss gently (don’t seek revenge). At point B, you should be proactive and not chase the trade because at point B it may be too late to enter .

From the Elliott Wave Theory perspective, the entire ABCD pattern is a correction that starts after a spike. ABCD pattern is also known as Measured Move and Swing Measurement. In the past, investors called it Measured Move, and mostly now they call it the ABCD pattern. TRX had a similarly Bullish ABCD BAMM Pattern on the FTX chart but that has since played out and gotten shut down.

The trading process is the same as discussed above but you may ask what if the price didn’t reverse after selling all shares? To avoid this kind of situation you can use the trailing stop loss strategy after point . At this point, we are going to explain a more simplified version of the ABCD pattern that actually works in the market. This is for informational purposes only as StocksToTrade is not registered as a securities broker-dealeror an investment adviser. If a stock’s very choppy or putting in more volume than the A leg during this period, it’s best to skip it. It might be a sign that there are a lot of short sellers fighting the buyers.

The range of results in these three studies exemplify the challenge of determining a definitive success rate for day traders. At a minimum, these studies indicate at least 50% of aspiring day traders will not be profitable. This reiterates that consistently making money trading stocks is not easy.

These https://forex-trend.net/s can go both ways and can thus be bullish or bearish. Depending on which it is, the investor will either buy or sell at the D point. There are various chart patterns that you will come across when trading and the ABCD pattern is just one of them. This particular pattern is a simple but effective one that can be used to identify potential reversals in the market.

As we’ll see in the later examples the BC projection level and the AB-CD projection level should fall in close proximity to each other thus giving the harmonic reversal zone. A dozen of harmonic patterns have been developed over the years, but interestingly, all of them are founded upon one basic pattern – the ABCD pattern. The ABCD is a simple Harmonic pattern that can usually be identified easily. Traders should consider the rules for confirming the pattern and not confuse it with price highs and lows.

As a result, we use some key Fibonacci ratio relationships to look for proportions between AB and CD. Doing so will still give us an approximate range of where the ABCD pattern may complete—both in terms of time and price. This is why converging patterns help increase probabilities, and allow traders to more accurately determine entries and exits. Now at point C, some new traders will enter and bring the price to the new highs of the day . The ABCD pattern is easy to spot in various markets, in any market condition, and on any timeframe.

- 0

Comentários