DXY USDollar Index Technical Support Resistance on Multi Time frame Technical analysis, Chart, Analysis

Contents

I suggest you keep this pair on your watchlist and see if the rules of your… The Dollar index witnessed over throw or fake breakout from ascending parallel channel due to excess optimism but it is now back into the channel. Pattern wise, it seems to be forming distribution triangle. MACD is also going negative in daily time frame along with turning towards negative in weekly time frame.

Let’s check out the mechanics of a buy or promote commerce earlier than we dive into a US greenback index trading strategy you can begin utilizing at present. Movement within the DXY chart largely impacts the worldwide commerce balance, offering many buying and selling opportunities for traders worldwide. But it’s within the foreign money markets the place the USDX is actively watched. Virtually all the main buying and selling pairs have the USD as a part, and these include the EUR-USD, USD-JPY, GBP-USD, USDCAD, AUDUSD and the NZDUSD. The chart above highlights occurrences of both rule one and rule two. In 1973, many international authorities selected to let their foreign money charges float, putting an finish to the agreement.

The ICE Futures U.S. took over management of the USDX in 1985, and futures buying and selling on the USDX began. Now you know the way to position a commerce on the US greenback index, the next query is when do you commerce it? The choice to buy or sell any market is usually decided by your buying and selling style and buying and selling technique. In reality, before you even contemplate dollar index investing it might show helpful to determine how you will produce a dollar index forecast to commerce from. So now you know how to view the US dollar index chart, how do you commerce it?

- Moving averages are often used to assist identify who is in charge of the market, consumers or sellers.

- I suggest you keep this pair on your watchlist and see if the rules of your…

- But it’s within the foreign money markets the place the USDX is actively watched.

- Due to the significance of the US greenback in financial markets, traders utilise the dollar index as a natural hedge for positions positioned on the currency markets.

You will be taught more about this in the US greenback index buying and selling strategy instance further down the article. You may have seen that within the above screenshot, the image code for the US greenback index futures CFD is USDX_Z9. This includes the dollar index’s symbol from the InterContinental Exchange ‘DX’ as well as the month and yr the present contract expires Z9 which is December 2019, using the codes discussed earlier on. The Admiral Markets code also has US in it to highlight it is the United States dollar. These currencies are the Euro (constituting 57.6% of the weighting), Japanese Yen (13.6%), British Pound (11.9%), Canadian Dollar (9.1%), Swedish Krona (4.2%) and Swiss Franc (3.6%).

The US Dollar Index was given a base value of a hundred.000 when it began. The index will rise if the Dollar strengthens in opposition to these currencies and will fall if the Dollar weakens against these currencies. Makes visual the theory that “a strong dollar is bullish for equities/stocks” …but oh man, these two are definitely not that strongly correlated. Dollar index making bullish harami on daily chat, If it’s validating the bullish harami, we may see a sharp fall on Tuesday on nifty.

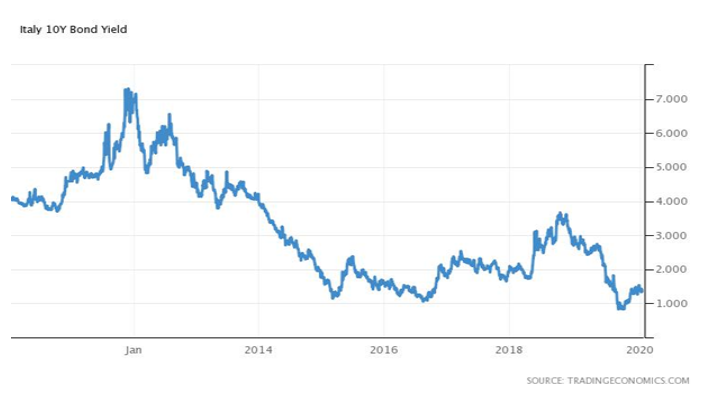

The main goal is to research if peaks and troughs in indexes actually correlate closely to the US dollar or 10YR US rates. However, that value can fluctuate over time, sometimes in a volatile fashion. As a rule, when the value of the dollar increases relative to other currencies around the world, the price of gold tends to dxy tradingview fall in U.S. dollar terms. It is because gold becomes more expensive in other currencies. Dollar Index Lower top breakout above 91.40 and higher top and higher bottom sequence is in place Expect 94 to be tested with volatility. Support of 91.4 need to be violated very quickly for world equities to prosper in near term.

Is quite excited in particular about touring Durham Castle and Cathedral. 👍-there are little Buying opportunities as the Major Oscillators indicators are in oversold zone. Settings allow for inverse settings and de-combining the two pairs as well as a nice cloud look if all the lines get annoying. This script was created due to the lack of position of US Dollar Index Futures . It is designed to perform a much more liquid and inclusive position analysis. As the exponential ratios do not mean anything to positions, weights are used as multipliers instead of exponential functions.

US Dollar Index Futures Streaming Chart

Beautiful Example of Price Action on H&S breakout on monthly candle. The mighty greenback reminds us what makes it mighty, bouncing back from its recent slouch while others fall into the red. Gartley harmonic is close to its target which gives some more space for BTC to push higher ~21.7k zone. Dxy reaction off this harmonic will be crucial for BTC. RATIO chart is indicating strengthening of BTC against DXY.

These monetary products currently trade on the New York Board of Trade. Plan your technical evaluation of the US Dollar Index by monitoring its worth in the chart and keep up with the latest market movements with news, recommendation pieces, and the dollar index forecast. The basket contains the Euro, the British Pound, The Japanese Yen and the Australian Dollar in equal amounts, which are equally weighted. It is geographically balanced and accounts for 80% of worldwide Forex activity. The DJ FXCM Index was introduced on January 1, 2011, at a value of 10,000.00, is calculated every 15 seconds and updated Monday to Friday.

Once it breaks down lower side of Triangle then it… Commodities Our guide explores probably the most traded commodities worldwide and how to begin trading them. Indices Get high https://1investing.in/ insights on the most traded stock indices and what moves indices markets. Cryptocurrencies Find out extra about high cryptocurrencies to trade and the way to get started.

The index measures the value of the US dollar relative to a basket of foreign currencies. The US dollar index was started in March 1973, when the world’s largest nations met and agreed to freely float their currencies in opposition to one another. This was quickly after the Bretton Woods settlement was deserted. For its part, the US greenback index was purposely created to provide an exterior consensual commerce-weighted average of the greenback’s value. Leveraged buying and selling in foreign currency or off-exchange products on margin carries significant risk and is probably not appropriate for all investors. We advise you to fastidiously think about whether trading is acceptable for you based in your personal circumstances.

DXY USDollar Index Technical Support Resistance on Multi Time frame

However, the ICE US dollar index continues to be probably the most broadly used by analysts and traders. Interactive chart of historical knowledge displaying the broad worth-adjusted U.S. dollar index revealed by the Federal Reserve. At the end of 2019, the DXY traded at ninety six.5, which means that the US greenback has slightly depreciated versus the basket of currencies since its institution in 1973. The euro holds essentially the most weight versus the greenback within the index, making up about fifty seven.6 per cent of the weighting, adopted by the yen with around 13.6 per cent.

The index started in 1973 with a base of one hundred, and values since then are relative to this base. A few macroeconomic elements have a major impact on the US Dollar Index value. The US Dollar Index serves as a benchmark for measuring the relative worth of the American dollar to a basket of currencies of the US’s key buying and selling companions. The US dollar index, or Dixie as it’s typically referred to, is the most popular foreign money index on the planet.

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. The US Dollar Index is used to measure the value of the dollar against a basket of six world currencies – Euro, Swiss Franc, Japanese Yen, Canadian dollar, British pound, and Swedish Krona. You can follow the ups and downs of the Dollar Index at Capital.com. Always keep on prime of the most recent price developments with our DXY stay chart. The US Dollar Index, also called DXY, is used by traders in search of a measure of the worth of USD against a basket of currencies used by US trade partners.

Dow Futures Trade Steady as Investors Brace for Fed Hike

Some retracement and continue the journey upward… Follow for more updates Do like and share this idea with your trading collegues / friends. RSI has formed positive divergence but yet not turned up.

Investors can use the index to hedge general forex strikes or to take a position. The index is also available not directly as part of exchange-traded funds , choices or mutual funds. – generally known as USDX, DXY, DX and USD Index – is a measure of the value of the United States Dollar in opposition to a weighted basket of currencies utilized by US trade partners. The index will rise if the Dollar strengthens in opposition to these currencies and fall if it weakens. Keep reading to be taught more on the US Dollar Index, how it’s calculated, and what impacts it price. One of the simplest ways to get started is to treat the US dollar index as another tradable market.

Nifty’s Opening Cues Ahead of Fed’s Policy Outcome: Global Markets, Oil Up

Commodity costs tend to fall because the Dollar will increase in worth – and vice versa. The USDX is out there in the options trading and futures markets, the place multiple timeframe contracts are provided. Due to the significance of the US greenback in financial markets, traders utilise the dollar index as a natural hedge for positions positioned on the currency markets. While not an ideal correlation because of this because the US greenback index falls, the EUR.USD exchange fee rises.

So be careful it’s just a intraday up move on tomorrow session. DXY ANALYSIS It has retracted to its Fibonnacci Level 0.5 (106.17) where it actes as a support and bounced back to its 0.382 (106.84) level which acted as resistance for now. Further drop is expected to 0.618(105.5) level before another pull up towards 1.618 (112.5 ) LEVELS THIS IS JUST A VIEW. DO YOUR OWN RESEARCH BEFORE DOING TRADE WITH PROPER RISK… Dollar index has been rising form 96 levels onwards.

There are sure benefits and drawbacks to buying and selling futures contracts which you can learn extra about in theCFD Trading vs Futures Trading article. Thus it looks like this is time for USD to probably pause for a few months as compared to other currencies. —- The index is currently calculated by factoring in the exchange rates of six foreign currencies, which include the euro… We advocate that you simply seek independent financial advice and ensure you totally understand the dangers concerned before buying and selling. Traders can use further technical instruments and analysis to additional refine the essential engulfing candlestick sample.

Circle marks the perfect support which should be touched by 23-26th July, if it has to work. The overall frame of the trend is still pointing 94 but positive divergence can’t be ruled out. Better to be on the sideline and see which support is in motion. The weekly charts for DXY show that the correction may continue till 99.

We recommend that you simply seek independent recommendation and make sure you totally perceive the dangers involved before buying and selling. An overvaluation of the USD led to considerations over the trade charges and their hyperlink to the way in which gold was priced. President Richard Nixon determined to briefly droop the gold normal, at which level different countries have been in a position to choose any change settlement aside from the price of gold. Dollar markets are open, which is from Sunday evening New York City native time for twenty-four hours a day to late Friday afternoon New York City native time. The DXY Index is often utilized by traders to monitor the worth of the USD compared to a basket of choose currencies in a single transaction. Leveraged trading in foreign forex contracts or other off-change merchandise on margin carries a high stage of risk and will not be appropriate for everybody.

- 0

Comentários