The difference between financial and managerial accounting

Content

Managerial accounting is more concerned with operational reports, which are only distributed within a company. The certification for each of these types of accounting is different as well. People who have been trained in financial accounting have a Certified Public Accountant designation, while those with a Certified Management Accountant designation are trained in managerial accounting. Conforming to these rules allows lenders and investors to directly compare companies based on their financial statements. Managerial accounting is the practice of analyzing and communicating financial data to managers, who use the information to make business decisions. Through this uniformity, investors and lenders compare companies directly on the basis of their financial statements. Moreover, financial statements are released on a regular schedule, establishing consistency of external information flows.

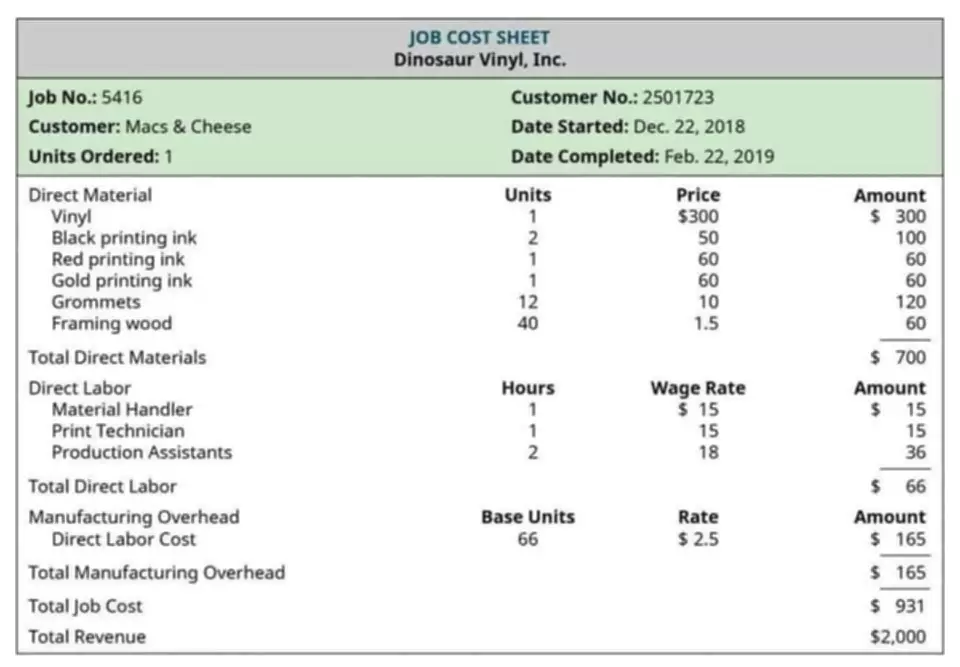

A business’ profitability and efficiency are reported through financial accounting. Managerial accounting reports on what is causing a problem and how to fix that problem. An example would be an internet company that uses cloud computing services for its employees. Financial accounting involves recording, summarizing, and reporting the stream of transactions and economic activity resulting from business operations over a period of time to the public or regulators. Managerial accountants produce financial documents that organizations use internally.

Statement Preparation

They provide financial governance through data collection and analysis, transaction reconciliation and record auditing. Financial accountants may also offer guidance on project funding and budget preparation. Personal finances are closer to financial accounting rather than managerial accounting. This is because your personal finances often involve the preparation of financial statements to show income and expenses, and tracking your net worth.

Open for academic commissions!

Forte: Accounting and math subjects.Financial accounting, basic accounting, intermediate accounting, cost accounting, managerial accounting, finance, obligations and contracts, statistics, and many more.

Lf clients, Lf accounting commissioner

A

— OPEN!- EducUnlocks/Commissions (@educunlocks) November 22, 2022

Financial accountants and managerial accountants need to have a solid understanding of accounting principles and use software such as spreadsheets, databases, and enterprise resource planning systems. Companies must keep accurate records of their financial transactions and prepare financial statements as per accepted principles. While there are certainly ways to slice and dice the data you get from financial accounting, managerial accounting let’s you get more granular. You can break out data and projections on a department-level basis, analyzing how the marketing team did against their specific goals, for example. We’re going to finish this topic by providing a table that summarizes the high-level differences between financial and managerial accounting approaches and reports.

Welcome to Financial & Managerial Accounting for Undergraduates!

Financial accountants should have at least a bachelor’s degree in accounting or a related field. Financial accountants are typically responsible for compliance with financial reporting standards. This means that they need to be up-to-date https://www.bookstime.com/ with all the latest changes in financial reporting standards. Managerial accounting statements are primarily for internal use by managers. They are not subject to specific rules or regulations and are not regulated by GAAP.

While there are rules that must be followed and taxes that must be filed, “accounting” as an umbrella term can mean a few different things. Depending on your answers to those questions, you may want to consider financial accounting. Keep reading to explore how they are different by reading what each specialization prioritizes and accomplishes. financial accounting vs managerial accounting Envision yourself doing some of the tasks described for this type of accounting to begin to form an opinion on which one feels right for your personal goals. Lastly, do not overlook the higher education and certification or licensure requirements as those often help professionals choose which specialization they want to pursue.

- 0

Comentários